Road tax changes 2025 are now in force across the UK, affecting petrol, diesel, hybrid and electric vehicles.

Road tax was one of the main incentives for switching to low or zero-emission vehicles. But since the last budget, everything has changed. The government has removed the zero-tax band, so nearly every vehicle owner will be affected, whether you drive a petrol, diesel, hybrid or electric vehicle.

This isn’t just about electric vehicles losing their tax exemption. It’s a wider reform of vehicle excise duty (VED), ensuring that as more drivers switch to lower-emission transport, everyone contributes fairly to maintaining the UK’s roads.

So, what does this mean for you, your car or even your business fleet? Let’s break it down.

How will the UK road tax changes affect you?

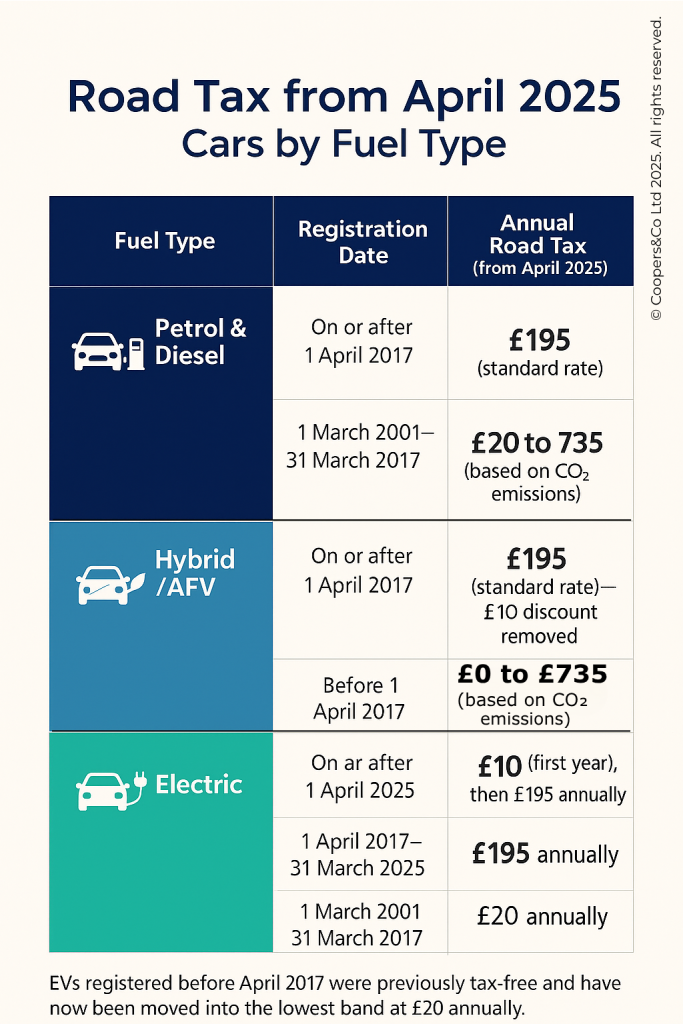

If you own a petrol or diesel vehicle, you’ll see a small change:

- Standard rate: £195 per year for vehicles registered on or after April 2017

- Older vehicles: Registered between 2001 and 2017 are taxed based on CO₂ emissions, with rates ranging from £20 to £735 per year

Rather than listing every rate here, we’ve included an infographic that summarises the new rates by fuel type. This makes it easier to digest the key information and compare at a glance.

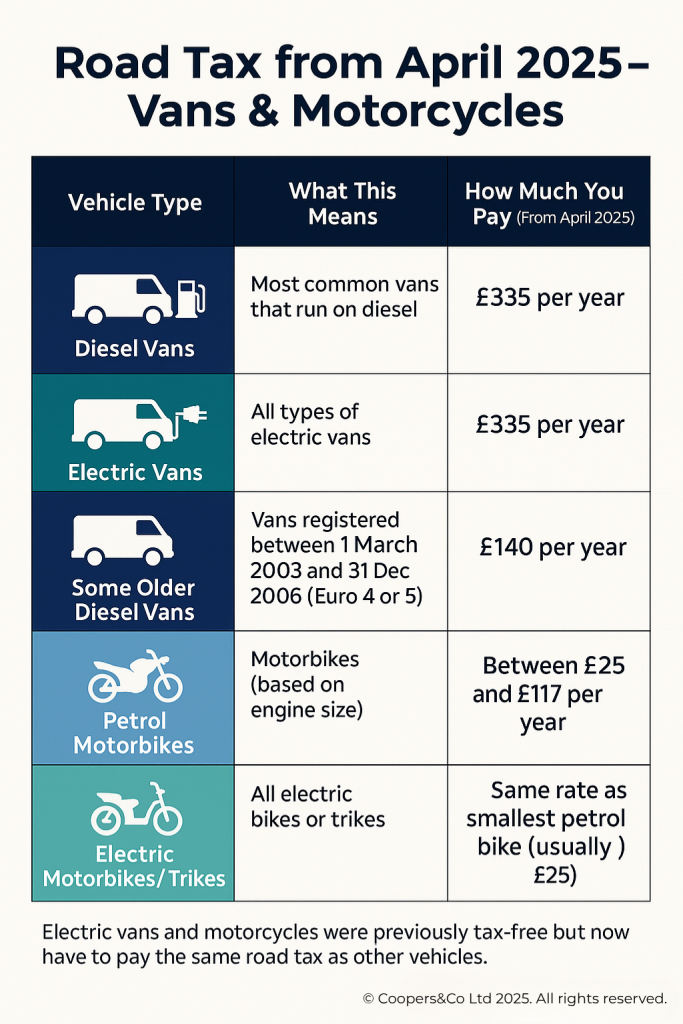

For vans

- Euro 4 and Euro 5 compliant vans: £140 per year

- All other vans: Flat rate of £335

For motorcycles

- Engine size based: Tax ranges from £25 for smaller models to £117 for larger ones

We’ve summarised this too in the same infographic to make the updates easier to understand.

What about hybrids and alternative fuel vehicles (AFVs)?

- Discount removed: £10 annual discount ends from April 2025

- Hybrids registered before April 2017: Taxed based on CO₂ emissions

- Hybrids registered from April 2017: Flat £195 per year

While this may seem like a modest shift, the total annual impact can build up, especially for households with multiple cars or businesses running fleets.

We’ve supported many clients in reviewing their fleet costs and making tax-efficient changes ahead of the reforms. If you’re unsure how this affects you, our team at Coopers&Co can help you explore your options.

What’s changing for electric vehicles?

- New EVs from 1st April 2025: £10 in the first year, increasing to £195 per year thereafter

- EVs registered 2017–2025: £195 per year

- EVs from 2001–2017: £20 annually

- Electric vans: £335 per year

- Electric motorcycles and trikes: Taxed as the smallest engine size, usually £25

These changes are significant for anyone who chose electric vehicles because of financial incentives. If you’re reviewing your vehicle strategy, whether upgrading or holding on, Coopers&Co can help you make the most cost-effective choice.

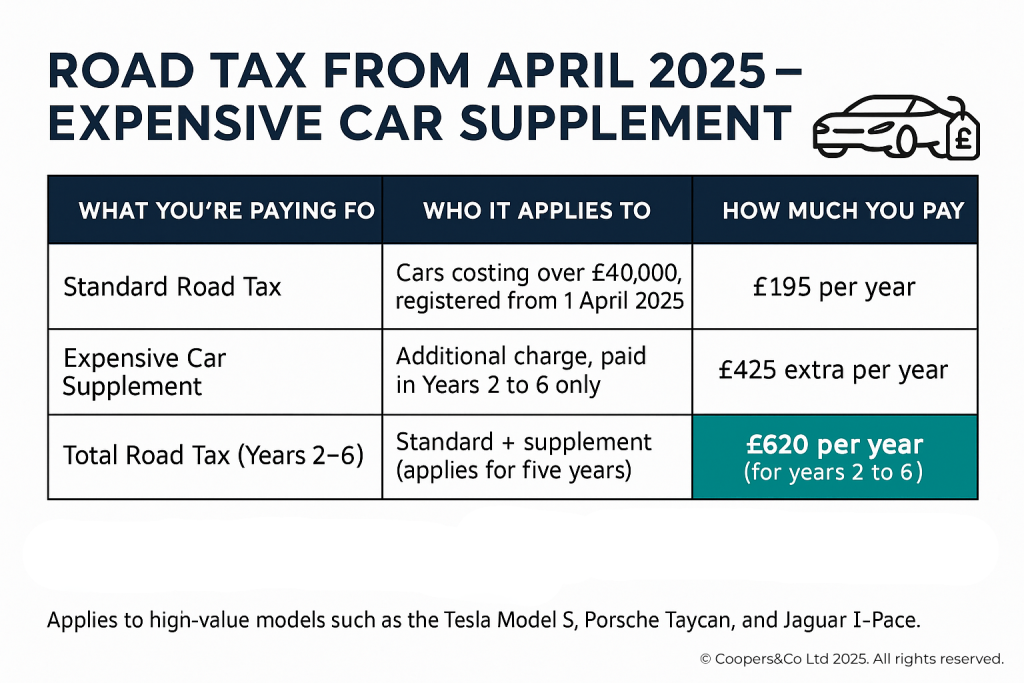

How will the changes impact luxury cars?

- List price over £40,000: Applies to vehicles registered on or after 1st April 2025

- Standard VED: £195 per year

- Supplement: Additional £425 per year for five years

- Total: £620 per year from years two to six

This applies regardless of whether the car is petrol, diesel, hybrid or electric. It includes models such as the Tesla Model S, Porsche Taycan and Jaguar I-Pace.

For company car strategies, this is essential to consider. Our advisers at Coopers&Co can help you structure your fleet planning around the new rules.

What to do about the road tax changes 2025

These road tax changes are broad, affecting almost every driver in the UK. It’s important to act early and understand how these costs could affect your household or your business.

- Review your existing vehicle ownership

- Assess how these new rates impact your budgeting

- Explore whether vehicle upgrades or timing your purchases differently could save money

We know navigating tax updates can be time-consuming. That’s why Coopers&Co offers a clear, personalised approach to vehicle-related tax planning and budgeting.

Request a callback from one of our advisers or subscribe to our newsletter for monthly insights, tax planning updates and regulatory tips tailored for UK businesses.